You might think that electric toothbrushes look the same across Europe. But that's not the case. How much they pay, which brands they buy, and what they're after can vary a lot from country to country. Add in differences in plug types, warranties, and brand pricing — and suddenly buying abroad feels a lot more complicated.

This guide compares average prices, popular brands, preferred features, and common concerns in the UK, Germany, France, Italy, and Spain. It also touches on practical details like plug compatibility and warranty rules — all to help you choose the right brush wherever you are in Europe.

At-a-Glance Country Comparison

|

Country |

Price Bands (Budget / Mid / Premium) |

Most Popular Brands |

Preferred Features |

Common Concerns |

Plug / Voltage |

Warranty / Returns Norm |

|

UK |

~£30–50 / £50–120 / £120+ |

Oral-B, Philips, Oclean, etc. |

pressure sensor, app tracking, gentle mode |

head cost, overpressure, battery life |

Type G (3-pin) / 230V |

1–2 years, retailer & brand policies |

|

Germany |

~€30–60 / €60–130 / €130–250+ |

Oral-B, Philips, local brands |

quiet operation, robust build |

counterfeit imports, head supply |

Type C / F (Europlug compatible) |

EU 2-year legal guarantee |

|

France |

~€30–60 / €60–130 / €130–250+ |

Philips, Oral-B, local chains |

sensitivity / gum modes, ease of use |

replacement head pricing |

Type C / E |

EU 2-year guarantee |

|

Italy |

~€30–60 / €60–130 / €130–250+ |

Philips, Oral-B, Curaprox (niche) |

battery / travel features, modes |

charging compatibility |

Type C / F / sometimes Italian "Type L" |

EU 2-year guarantee |

|

Spain |

~€30–60 / €60–130 / €130–250+ |

Philips, Oral-B, Colgate, Foreo (luxury) |

value packs, pressure indicators |

promo timing, head bundles |

Type C / F |

EU 2-year guarantee |

How We Performed This Analysis

This guide relies on publicly available data from manufacturer websites, major retailers (Amazon, Boots, dm, Carrefour, MediaWorld, and El Corte Inglés), and price comparison platforms.

We grouped prices into three broad categories — budget, mid, and premium — using standard retail prices (RRP) rather than short-term promotions.

Key Regional Differences

· Brands: Oral-B and Philips dominate across Western Europe, though with local variation — Philips is strongest in France, while Oral-B leads in Germany.

· Head costs: A common complaint everywhere. Multipacks are especially popular in Spain, while French buyers often pay premium prices for Philips heads.

· Prices: Broadly similar across Western Europe, but the UK is usually 5–10% more expensive at the mid–premium tier.

· Warranty: EU countries benefit from a legal 2-year guarantee, whereas the UK typically offers only 1–2 years depending on retailer or brand.

· Plugs: The UK uses the three-prong Type G plug. Most of continental Europe uses Type C or F, which makes cross-border purchases easier. Italy is the exception, where the Type L plug is also found alongside Type C/F.

Country Overviews

United Kingdom

Quick Facts

· Popular Brands: Oral-B, Philips Sonicare, Oclean

· Plug Type: Type G (often a 2-pin shaver plug adapter in bathrooms)

· Warranty: 1–2 years, depending on brand/retailer

· Pricing: ~£30–50 / £50–120 / £120+

Market Overview

The United Kingdom is by far the most divergent market in Western Europe. Outside the EU, differences in currency and standards mean UK consumers often pay slightly more for an electric toothbrush, particularly at the mid-premium tier. This is largely due to higher distribution and retailer margins, which push retail prices above continental averages.

Overall, the UK remains highly competitive, with Oral-B leading and Philips Sonicare close behind. However, several smaller brands are starting to challenge this duopoly — including Bruush, SURI, and Oclean — often focusing on eco credentials or direct-to-consumer online sales.

From a regulatory standpoint, the UK does not benefit from the EU's mandatory two-year legal guarantee. Instead, warranties are typically limited to 1–2 years, depending on the brand and retailer.

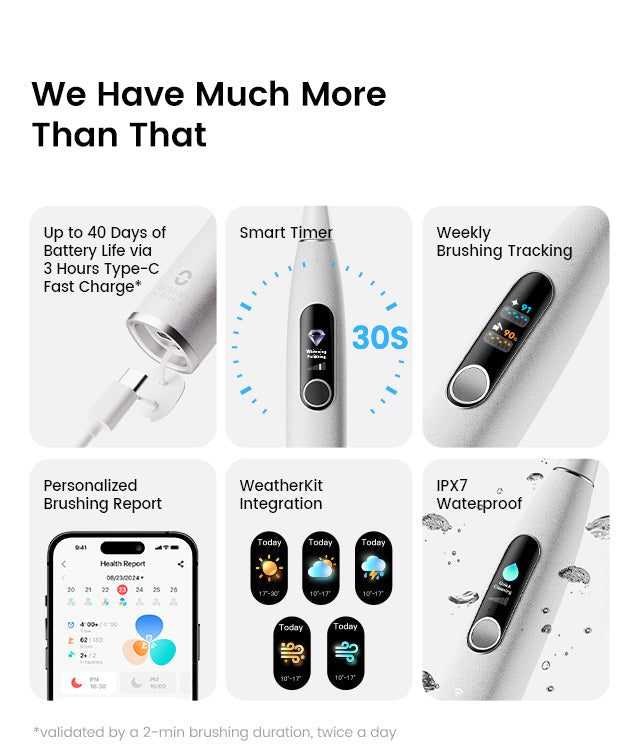

Preferred Features

UK buyers are tech-savvy, and features like pressure sensors, app-based feedback, and multiple cleaning modes are highly sought after. This partly explains why tech-led brands such as Oclean resonate with consumers. Sonic brushes are increasingly popular, although oscillating models still dominate in overall sales.

Common Concerns

Replacement head costs are a major frustration for UK consumers. There is also a growing awareness of the risks of overbrushing, making overpressure sensors particularly valued.

Germany

Quick Facts

· Popular Brands: Oral-B, Philips Sonicare, Oclean

· Plug Type: Type C / F (Europlug compatible)

· Warranty: EU 2-year legal guarantee

· Pricing: ~€30–60 / €60–130 / €130–250+

Market Overview

Germany is one of Oral-B's strongholds, thanks to the brand's long association with Braun and its oscillating brush heads. Oral-B continues to lead the market, although growing interest in sonic technology has opened space for brands like Philips Sonicare, Oclean, and niche players such as Curaprox.

Prices are broadly in line with other EU countries, and consumers benefit from the standard two-year EU legal guarantee. Most purchases are made in drugstores (dm, Rossmann) and electronics retailers (MediaMarkt, Saturn), with online shopping steadily gaining share.

Preferred Features

German buyers tend to prioritise robust engineering and long-term quality over flashy tech. Reliable pressure control, long battery life, and durable build quality are valued most. Quiet sonic models are becoming increasingly popular, though oscillating brushes remain the default choice for many.

Common Concerns

Counterfeit replacement heads are a major concern in Germany, linked to high prices and inconsistent availability. While companies market new app-based features, many consumers report "app fatigue," preferring a brush that performs reliably without unnecessary add-ons.

France

Quick Facts

· Popular Brands: Philips Sonicare, Oral-B, Oclean

· Plug Type: Type C / E

· Warranty: EU 2-year legal guarantee

· Pricing: ~€30–60 / €60–130 / €130–250+

Market Overview

Philips overwhelmingly dominates the French market. French consumers lean more heavily towards sonic technology than in either the UK or Germany, making Philips Sonicare the obvious first choice. Concerns around gum care and sensitive teeth over "power scrubbing" fit perfectly with Sonicare's brand positioning. Philips also invests heavily in pharmacy distribution, which boosts its credibility among health-conscious consumers.

However, this openness to sonic brushes has opened the doors to new brands. Oclean and Foreo are growing online, but they're still nice compared to Philips. Oral-B remains a close second behind Philips, however, especially for oscillating brushes.

Preferred Features

In France, everything is geared towards sensitive teeth and gums. Gentle sonic brushes, softer bristles, and sensitive/gum care modes are the go-to option. But, in line with French simplicity, there is also a preference for a simple UX and sleek design.

Common Concerns

Due to Philips' dominance, premium Philips head pricing is the biggest concern. The recurring cost of heads can quickly outweigh the initial cost of the brush. Other concerns include overpressure irritation and noise levels.

Italy

Quick Facts

· Popular Brands: Oral-B, Philips Sonicare, Oclean (plus niche Curaprox)

· Plug Type: Type C / F, and sometimes Type L

· Warranty: EU 2-year legal guarantee

· Pricing: ~€30–60 / €60–130 / €130–250+

Market Overview

Italy is perhaps the most unique of the continental European countries. There's a balance between sonic and oscillating brushes, with Oral-B being the most popular brand overall. Philips Sonicare comes second, dominating the sonic market. However, brands like Curaprox have carved a strong niche, and Oclean performs well online.

Seasonal promos — like Black Friday and summer sales — drive much of the buying habits. Indicating Italian consumers favour a bargain over other features. Online reviews are also prominent in determining which electric brushes succeed.

Preferred Features

Italians have two primary concerns: travel and appearance. Travel-friendly brushes featuring USB and long battery life (alongside compact chargers and cases) perform exceedingly well. While whitening modes are popular for many.

Common Concerns

Like all European countries, finding replacement heads at a fair price is crucial. But the unique Type L plug limits foreign purchases and makes charger plug compatibility a real issue in the market.

Spain

Quick Facts

· Popular Brands: Oral-B, Philips Sonicare, Oclean (plus Colgate, Foreo niche)

· Plug Type: Type C / F

· Warranty: EU 2-year legal guarantee

· Pricing: ~€30–60 / €60–130 / €130–250+

Market Overview

Spain has one of the most varied electric toothbrush markets in Western Europe. Oral-B and Philips Sonicare remain the dominant brands, but challengers such as Oclean, Colgate, and Foreo are carving out their own niches, particularly through Amazon and online-first sales. Retailers like El Corte Inglés, Carrefour, and Worten also play a big role, with frequent bundle promotions driving purchasing decisions.

Preferred Features

Spanish consumers tend to look for value-oriented bundles and multipacks, making affordability and long-term cost key.

Pressure sensors and simple brushing modes are appreciated, but there is less appetite for overly complex app integrations. Quiet operation and decent battery life are also valued, especially for family households where multiple brushes are in use.

Common Concerns

The ongoing cost of replacement heads is a major issue, with shoppers actively chasing multipack discounts or retailer promos. Promo timing is important in Spain, with many buyers waiting for seasonal sales or retailer events before upgrading. Reliability and warranty coverage are also points of attention, given the popularity of imported or online-only brands.

Indholdsfortegnelse